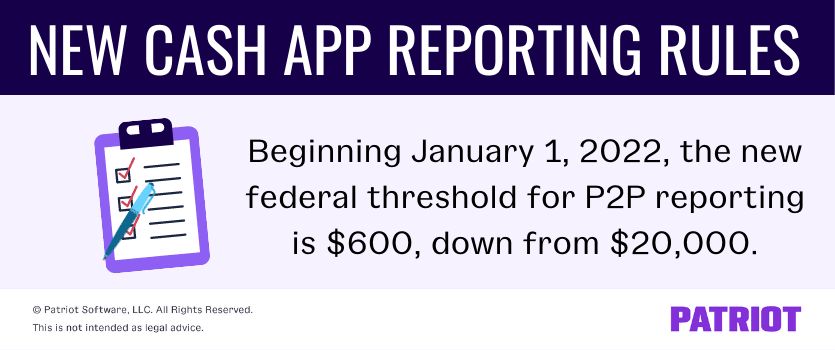

By lowering the reporting threshold from 20000 to 600 the IRS will get that transaction information from the cash app platform. 1 2022 people who use cash apps like Venmo PayPal and Cash App are required to report income that totals more than 600 to the Internal Revenue Service.

Irs Uber Mileage Log Tax Deduction With Triplog Tracking App Tax Deductions Tracking App Mileage

Cash apps like Venmo Zelle and PayPal make paying for certain expenses a breeze but a new IRS rule will require some folks to report.

. Here are some facts about reporting these payments. VERIFY previously reported on the change in September when social media users were criticizing the IRS and the Biden administration for the change some claiming a new tax would be placed. Personal Cash App accounts are exempt from the new 600 reporting rule.

For any additional tax information please reach out to a tax professional or visit the IRS website. Payment app providers will have to start reporting to the IRS a users business transactions if in aggregate they total 600 or more for the year. 1 2022 users who send or receive more than 600 on cash apps must report those earnings to the IRS.

Can you report on cash App. What does this mean say I received 50k on cash app for my personal account do I got to pay taxes on that money and will I get a tax for because what if u dont have history of all transactions. They certainly will not rely on self-reporting and will cross-reference both your reporting and third-party payment companies reporting.

Cash App Support Tax Reporting for Cash App. A business transaction is defined as payment. Personal Cash App accounts are exempt from the new 600 reporting rule.

However in Jan. According to the Cash App website certain accounts receive 1099 tax forms. Yes you can use cash app for the tax refund deposit.

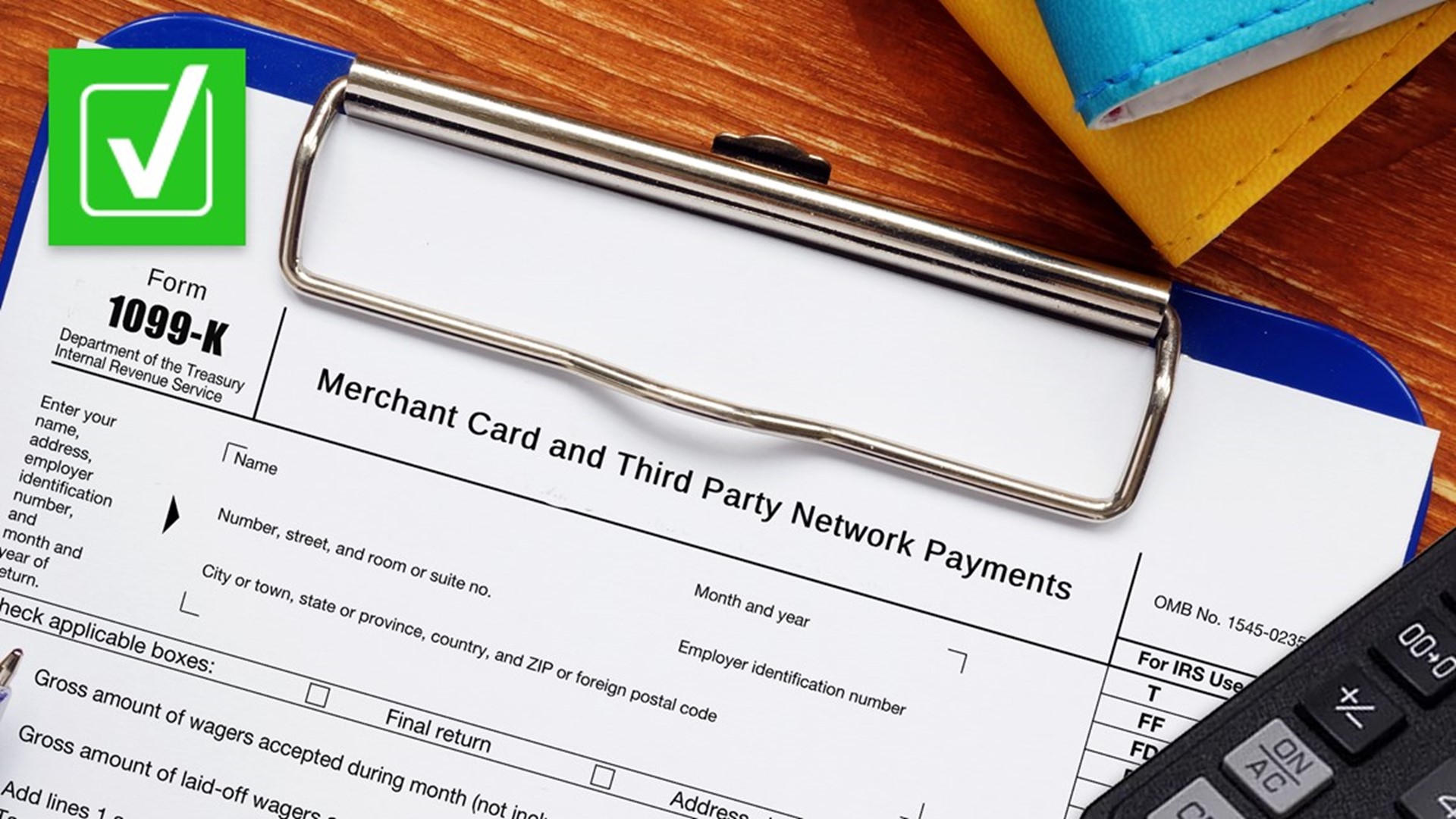

Certain Cash App accounts will receive tax forms for the 2021 tax year. Now Cash App and other third-party payment apps are required to report a users business transactions to the IRS if they exceed 600 annually. 1250 PM EDT October 16 2021.

PayPal Venmo and Cash App to report commercial transactions over 600 to IRS Americans for Tax Reform President Grover Norquist discusses the impact of third-party payment processor apps. Contact a tax expert or visit the IRS. Whos covered For purposes of cash payments a person is defined as an individual company corporation partnership association trust or estate.

If you have a standard non-business Cash App account you dont need to worry about Form 1099-K. There Is NO 600 Tax Rule For Users Making Personal Payments On Cash App PayPal Others. 2022 the rule changed.

Any errors in information will hinder the direct deposit process. Cash apps like Venmo Zelle and PayPal make paying for certain expenses a breeze but a new IRS rule will require some folks to report cash app transactions to the feds. 1 mobile money apps like Venmo PayPal and Cash App must report annual commercial transactions of 600 or more to the Internal Revenue Service.

If you receive a suspicious social media message email text or phone call regarding the Cash App or see a phone number that you believe is. So now apps like Cash App will notify the IRS when transactions get up to 600. Starting January 1 2022 if your Cash App Business account has gross sales of 600 or more in a tax year Cash App must provide a Form 1099-K to the IRS.

Log in to your Cash App Dashboard on web to download your forms. Nothing to do with the transfer method currency etc. This is far below the previous threshold of 20K.

The American Rescue Plan includes language for third party payment networks to change the way. Some businesses or sellers who receive money through cash apps may not have been reporting all the income. The IRS wants to make sure theyre getting their cut of taxes.

Only customers with a Cash for Business account will have their transactions reported to the IRSif their transaction activity meets reporting thresholds. Cash App wont report any of your personal transactions to the IRS. You need to pay taxes on your income.

Previously those business transactions were only reported if they were more than 20000 at the end. IRS Tax Tip 2019-49 April 29 2019 Federal law requires a person to report cash transactions of more than 10000 to the IRS. With this said we recommend creating separate Zelle Cash App Venmo or PayPal accounts to separate your business and personal transactions.

Users with Cash App for Business accounts that accept over 20000 and more than 200 payments per year will receive a. If you receive 600 or more payments for goods and services through a third-party payment network such as Venmo or CashApp these payments will now be reported to the IRS. A new law requires cash apps like Venmo and Cash App to report payments of 600 or more to the IRS.

As long as your account is under your real name and correct address. As part of the American Rescue Plan Act cash apps will now report commercial income over 600. How do these changes affect you.

Updated 316 PM ET Mon January 31 2022. As of January 1 the IRS will change the way it taxes income made by businesses that use Venmo Zelle Cash App and other payment apps to receive money in. Under the original IRS reporting requirements people are already supposed to.

If you use payment apps like Venmo PayPal or CashApp the new year ushered in a change to an IRS tax reporting rule that could apply to some of your. The IRS will also receive a copy of the 1099-K.

Does Cash App Report Personal Accounts To Irs New 2022 Tax Rules

Irs Has New Ways Of Taxing Cash App Transactions

Here Are The Tax Changes Coming To Venmo Cash App Paypal And Other Apps Forbes Advisor

Fillable Form 8822 B Change Of Address For Business Change Of Address Form Internal Revenue Service

What To Know About The Irs New Reporting Requirements For Venmo Paypal And Other Payment Apps

The Irs Says Criminals Have To Report Illegal Income Seriously Upworthy

Income Reporting How To Avoid Undue Taxes While Using Cash App Gobankingrates

![]()

Tax Reporting With Cash For Business

Getting Paid On Venmo Or Cash App This New Tax Rule Might Apply To You

What Cash App Users Need To Know About New Tax Form Proposals 12newsnow Com

Does The Irs Want To Tax Your Venmo Not Exactly

All About Forms 1099 Misc And 1099 K Bookkeeping Business Business Tax Organization Solutions

New Tax Laws 2022 Getting Paid On Venmo Or Cash App This New Tax Rule Might Apply To You Abc7 Chicago

Does Cash App Report Personal Accounts To Irs New 2022 Tax Rules

Changes To Cash App Reporting Threshold Paypal Venmo More

Cash App Income Is Taxable Irs Changes Rules In 2022

Tas Tax Tip Use Caution When Paying Or Receiving Payments From Friends Or Family Members Using Cash Payment Apps Tas

Changes To Cash App Reporting Threshold Paypal Venmo More

Getting Paid On Venmo Or Cash App This New Tax Rule Might Apply To You News Wsiltv Com